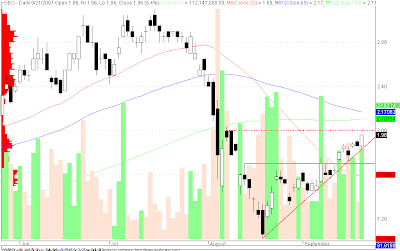

GEO - good demand line

GEO = 1.96 (5.4%)

Disclosure: I was about to let go of all my positions at GEO during the last trading day. It seemed to me that it was forming a lower low as compared to the previous trading day. As I waited until the last glimmer of hope that the demand side of the bid and ask spread vanished... suddenly demand volume picked up and propelled GEO to a higher high and forming a white candle with a shaven head - a bullish sign. (note: sometimes hope can work for you but hope always hampers discipline, therefore not good to hope - when it involves working you plan).

From the chart of GEO you can see that I have drawn a demand line that is yet to be broken. What impedes this demand line are the resistances being cast by the 130MA (2.10) and 65MA (2.16/2.18). Another concern is the psychological resistance at 2.

We can look for support at the previous resistance at 1.7.

Can we still buy GEO at this point? If you would like to take advantage of the support at 1.7 and resistances at 2, 2.1, 2.16/2.18, you can :) At most with a target price at 2.18 and buying it at 1.96 we can achieve 11% (that is if we cross over the other resistance levels and take note 65MA will likely go down as long as it isn't crossed by price movement). We can have a stop placed at 1.7 after buying at 1.96... 13% risk. So you reward for taking 13% risk is 11%, not that good.

As for me, I will hold my positions at GEO buy more if there is volume with a white candle or if the price crosses above the 65&130MAs. I will sell on weakness and will let go of all my positions in GEO if it break the demand line.

Note: Stochastic now at overbought levels

Good luck to all GEO traders!

Comments