day trading notes

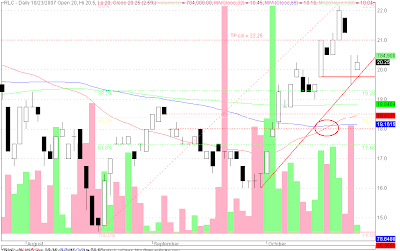

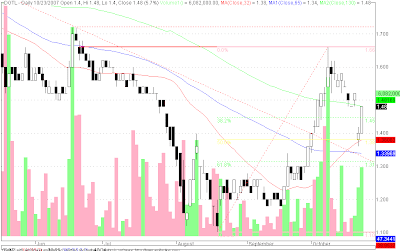

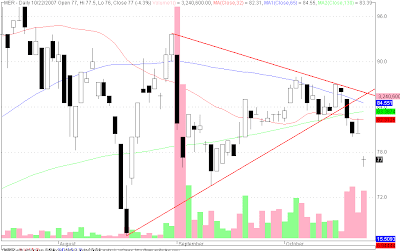

Bought MER at 83; higher high Bought GMAP at 8.6; island gap reversal Bought TA at 2.28; i thought it was going to be suspended when it hit 2.3, the ceiling price for today; bought more at 2.26; bought more at 2.2; bought more at 2.16 Bought DIZ at 10.25 PX gap up and trading at all time high; having trouble breaking thru resistance at 9.7; px new all time high at 9.8 GEO higher high and higher low; trading above 2.5; 2.5 might be new support TA possible gap up with very big volume... buy at close if gap up not closed :) might test 1.9 at all time high :) all time high! change in fluctuation at 2 :) DIZ possible gap up PERC possible gap up and possible breakout at 11.75 resistance with volume NRCP lower low... PCOR higher high possible higher low