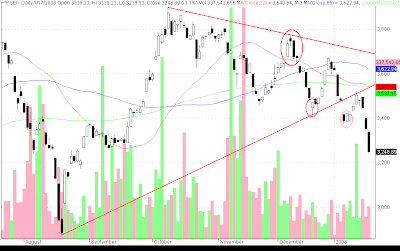

Day trading notes PSEi opens lower than previous close. PSEi succumbs to sell off of US stock market last friday. PSEi seems to have made a white candle by closing the trading day on its high. News: 1. The banking industry’s NPL ratio rose to 5.29% in October from 5.19% in September. 2. Meralco files for rate hike. 3. The BSP approved BDO’s joint ventures with Sta. Lucia, Filinvest, and Crown Asia 4. IPVG Corp. increased its all-cash takeover offer for PeopleSupport to US$17/sh from only US$15/sh. (News from the Philippine Daily Research section of Citiseconline.com; please visit their website for more information regarding these developments) PSEi gainers: BPI, GLO, SMPH, AC, SM, JGS, HLCM, LCB Note: Ayala companies holding the index steady with their gains PSEi biggest loser: TEL; the index heavywieght pulled the index back 17.10 pts.