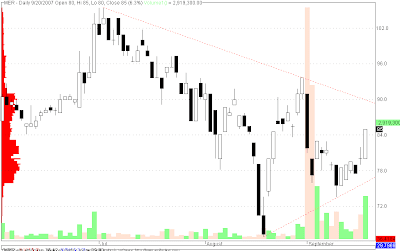

DJIA Daily 21September2007

DJIA = +53.49 (0.39%) DJIA closed higher. It managed to close higher than its open producing a white candle with a short upper shadow and a shaven bottom, which might mean that the bulls took over the trading today but there was some uncertainty after reaching the high 13877.17 and 1382.19, the close. I think it is a concern that it has been producing lower highs for last three trading days, which might be a signal of weakness. It is of great comfort that prices are above three short term moving averages (9,18,27MAs) which is a signal of bullishness in the short term. So what will the coming trading day for PSEi be like? Most likely there is less risk for PSEi to go down, not that it wont. So pick your issues carefully over the weekend and I do hope that I can share some of my thoughts with you about our local market before the opening bell on Monday. Happy wet weekend! Take care and God bless!