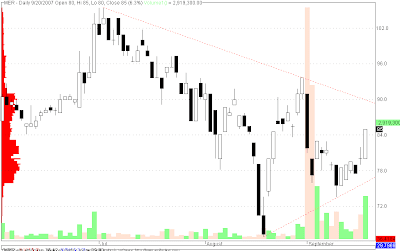

MER testing supply line (resistance)

Thank you again for visiting this blog :)

Disclosure: I bought MER again today at 84 minutes before it closed at 85 :) tsamba :)

Looking at the Chart I drew 2 lines approximating the supply and demand lines for MER.

Although not presented here are the Moving averages for simplicity of the chart it is nice to note that the price movement towards the close of 85 today moved above the 32MA which might signify an uptrend in the short term and that it may become the support at 82/83 level. Also nice to note that the 65MA now at 88/89 level will serve as a resistance.

So why did i get more of MER?

1. It managed to move above 83 which was acting as a resistance level

2. It moved with significantly higher volume (over the last 10 trading days)

3. There was a lot of foreign buying (2nd most foreign buying; 2nd to TEL)

Target price: I'm not sure it MER broke out of an area pattern or if there are clear signs of reversal towards an uptrend. So I'm pegging a sell at the resistance being shown by the supply line and the 65MA at 88/89 level, if there is a sign of weakness in the upward sentiment (e.g. formation of a lower low or a lower high for the price). If no such weakness occurs and it breaks out of the supply line with volume, I would hopefully wait for a clear sign of reversal so I can hope to maximize profits. (note the use of hope in the recent statement)

Good luck to all MER traders :)

I do hope that we don't become another technical insider now that we have positions at MER :)

Comments