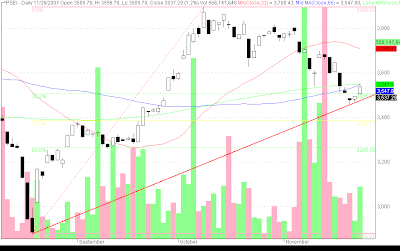

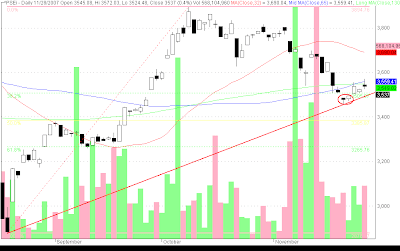

PSEi - black candle

PSEi = 3537 ( 0.4% ) PSEi formed a black candle with higher high and higher low. 130 and 65 MAs still resisting bullishness of PSEi. PSEi seems to have formed an island reversal, which has been confirmed by the formation of higher lows and higher highs following the formation of the island PSEi formed a black candle eventhough US markets were bullish (behind the news of infusion of cash to Citibank). Resistance: 3572 Support: 3505-3496 (previous gap up) Good luck to all traders!