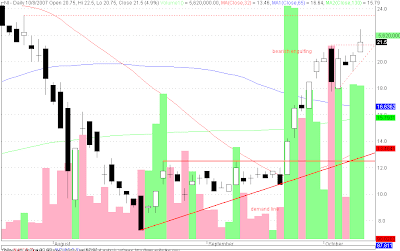

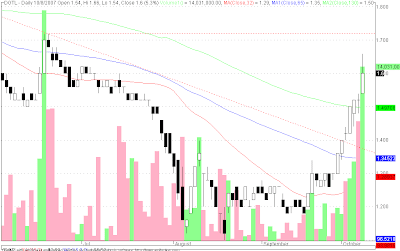

AT - testing supports

AT = 15 ( -1.6% ) AT after the rally to reach a recent high of 16.5 is now forming lower highs and lower lows and looks to test supports. AT is testing the a support level made by a previous gap down. Applying a fibonacci retracement on AT we will note that a healthy 38.2% retracement is around 14/14.25 level. 32MA recently crossed above 65MA to support bullishness of AT. 32 & 65MA acting as support levels. 130MA acting as level of resistance Resistance: 16.5 Support: 14.75 Good luck to all AT traders!