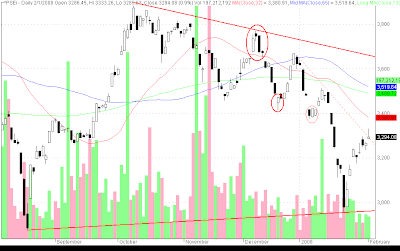

PSEi weekly formed a white candle with higher high and higher low. Previous candle which looked liked a bullish hammer seems to have been confirmed by formation of higher low and higher high. "...candlesticks with with long lower shadows and small real bodies. The real bodies are near the top of the daily range." - Steve Nison, description of a hammer and hanging man lines, on his book Japanese Candlestick Charting Technique Nison continued to state that: "If either of these lines emerges during a downtrend it is a signal that the downtrend should end. In such a scenario, this line is labeled a hammer, as in 'the market is hammering out' a base. Interestingly, the actual Japanese term for this line is takuri. This word means something to the effect of "trying to gauge the depth of the water by feeling for its bottom." I included this description from the authoritative book by Steve Nison on Japanese Candlesticks, as requested by an avid reader of th...