Posts

Showing posts from 2008

The Big Fall (part 1: the cause)

- Get link

- X

- Other Apps

By

ninodal

-

Dow dives 777 points as House rejects bailout plan (from yahoo.com) NEW YORK - The failure of the bailout package in Congress literally dropped jaws on Wall Street and triggered a historic selloff — including a terrifying decline of nearly 500 points in mere minutes as the vote took place, the closest thing to panic the stock market has seen in years. The Dow Jones industrial average lost 777 points Monday, its biggest single-day fall ever, easily beating the 684 points it lost on the first day of trading after the Sept. 11, 2001, terrorist attacks. U.S. stocks hammered after House rejects rescue Dow posts biggest point loss ever, topping plunge after Sept. 11, 2001 By Kate Gibson, MarketWatch NEW YORK (MarketWatch) -- Stocks plunged Monday, with the Dow industrials plunging 777 points or their worst point drop on record, as the House of Representatives voted down the government's $700 billion financial bailout package. Congress calls Wall Street's bluff, and we lose Commentary...

[dot]NEWbie

- Get link

- X

- Other Apps

By

ninodal

-

I recently received an email inviting me to include in my blog roll or blog list a site named [dot]NEWbie I decided to check out the site. It was delightful to view his commentary about the PSE and the lack of local investors. It was great that he placed in the numbers for us. I would really like to have the research that he was "quoting" but alas there is not link to the source. Please visit the site :) http://dotnewbie.com/ Its been quite a while now since I last posted... albeit look at any charts... Im planning to become more active again in the near future and TEL has sparked my interest. Hopefull I can materialize this planned before October ends :) Good luck to all the traders! Thank you for reading :)

AT - moving above possible resistance

- Get link

- X

- Other Apps

By

ninodal

-

AT = 16.75 (+6.3%) AT formed a white candle with higher high and higher low. Volume of 9.4M greatest since 15 November 2007. AT was able to move above possible resistance of 16.5. Might test possible resistances at 16.75 and 17.25. Price of AT above the 32MA. AT still oversold based on the RSI at 77.8 MACD again poised to cross above the signal line, both above the zero line = Buy long AT pushing the upper Bollinger Band. AT hit the parabolic SAR which was serving as a level of resistance. Good luck to all AT traders!

NRCP - Support at 2.6; resistance at 2.95

- Get link

- X

- Other Apps

By

ninodal

-

NRCP = 2.65 (+1.90%) NRCP formed a white candle. Volume continues to decrease. NRCP seems to be testing support at 2.6. I hope the support holds. Fibonacci Retracement: more than 61.8%. Unhealthy retracement. NRCP will find it difficult to achieve the similar high formed by the previous rally or uptrend. 32MA acting as level of resistance. MACD: MACD crossed below signal line above the zero level to signal sell long. NRCP weekly: formed another black candle with lower low and lower high. Rally or Uptrend failed to move above a possible resistance at 2.95. Corrected more than 61.8% of the Fibonacci retracement level. Unhealthy retracement. Rally or uptrend less likely to occur following drastic correction. Seems to be forming aggressive supply or resistance line. Careful NRCP traders...

DJIA weekly - testing resistance at 12,800

- Get link

- X

- Other Apps

By

ninodal

-

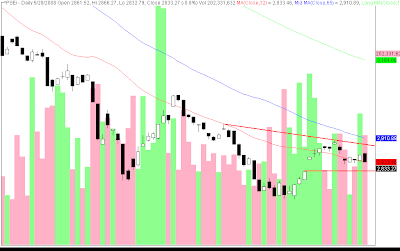

PSEi weekly - bearish engulfing

- Get link

- X

- Other Apps

By

ninodal

-

PSEi weekly formed a black candle with lower high and lower low. PSEi weekly seems to have formed a top for the recent rally or uptrend. A reversal pattern: the bearish engulfing seems to have been formed. It will be confirmed by the formation of a lower low and lower high for the next trading week. PSEi seems to be forming an aggressive supply or resistance line. PSEi seems to be headed to test the possible aggressive demand line. Careful traders...

ATN - possible top

- Get link

- X

- Other Apps

By

ninodal

-

ATN = 5.0 (-2.0%) Daily: ATN formed a black candle with lower low and lower high. Volume continues to decrease for the 4th trading day. ATN seems to continue to be forming lower highs. Caution should be exercised as ATN might be correcting as in the short term. Support might be felt at 4.9 Weekly: ATN formed a black candle with higher high and higher low. It is uncertain whether the black candle is signaling a top for the uptrend of ATN. If it is the top of the uptrend a correction towards 4.02, the 38.2% fibonacci retracement level, would be healthy and would be a good price to buy ATN again after hopefully selling at the possible high of 5.4 Careful ATN traders...

PSEi - 6th black candle

- Get link

- X

- Other Apps

By

ninodal

-

PSEi = 2940.98 (-0.50%) PSEi again formed another black candle but with higher low and higher high. Volume increasing. There seems to be a support level forming at 2932. I hope it holds :) 32MA still acting as level of resistance. Parabolic SAR still signaling a possible rally or uptrend. Good luck to all traders!